Tired of watching your retirement nest egg shrink due to market volatility and inflation? Imagine a future where your savings are secure, transparent, and accessible, even in the face of economic uncertainty. This isn’t a pipe dream; it’s the power of the blockchain revolution, specifically, cryptocurrency. Forget the old, outdated financial system – cryptocurrency offers a new path to a secure retirement, one that empowers you to take control of your financial future.

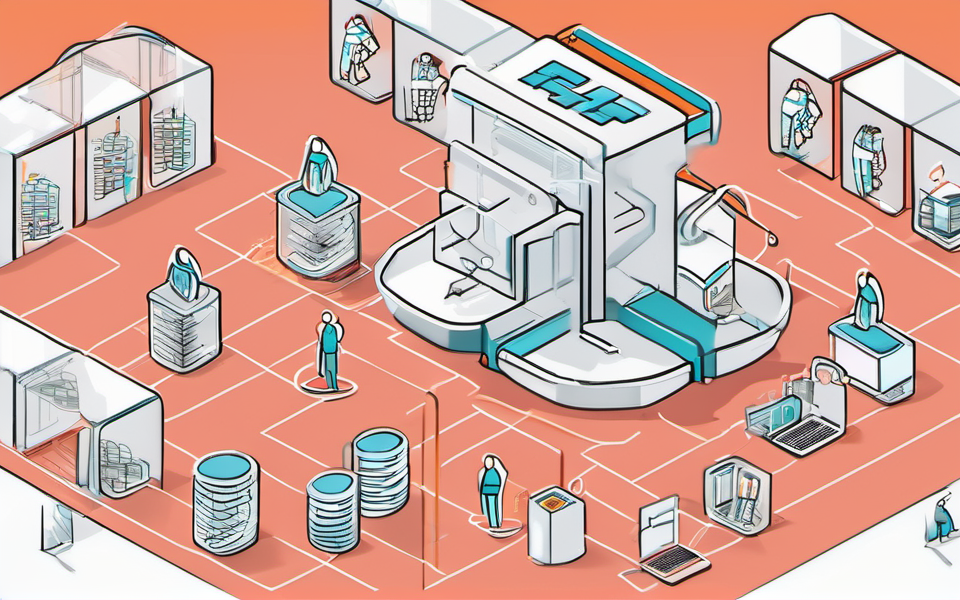

Embracing Decentralized Finance for Retirement

Breaking Free From Traditional Financial Institutions

Traditional retirement plans are often plagued by high fees, hidden costs, and a lack of transparency. Your savings are vulnerable to market fluctuations, inflation, and even government intervention. You may find your options limited, leaving you at the mercy of institutions that prioritize their interests over yours. But imagine a financial system built on decentralized finance (DeFi), a system that offers true control, transparency, and security. This is the promise of cryptocurrency for retirement planning.

Understanding DeFi’s Role in Retirement Planning

DeFi empowers you by giving you control over your finances. No more middlemen, no more opaque processes – just you and your crypto assets. Here’s how DeFi plays a key role in your retirement journey:

- Smart contracts are self-executing programs that eliminate the need for intermediaries, automating transactions and ensuring complete transparency.

- Decentralized exchanges (DEXs) provide secure and efficient trading platforms without the reliance on centralized institutions. This removes the risk of account freezes, censorship, and manipulation.

- Cryptocurrency lending and borrowing platforms enable you to earn interest on your crypto holdings or borrow funds against them, providing flexibility and opportunities for passive income.

- Decentralized stablecoins offer price stability, protecting your savings from the volatility often associated with cryptocurrencies.

These DeFi tools give you unprecedented control over your retirement funds. You can choose the investments, set the rules, and manage everything directly, maximizing your savings potential and mitigating risk.

Exploring Cryptocurrencies for Retirement

Building a Diverse Retirement Portfolio with Crypto Assets

Building a diverse portfolio is crucial for retirement planning, and crypto offers a wealth of opportunities. Forget the conventional stocks and bonds; diversify your portfolio with digital assets such as Bitcoin (BTC), Ethereum (ETH), and other established altcoins. Explore projects like:

- Chainlink (LINK): This project provides secure and reliable data to smart contracts, a vital component for the DeFi ecosystem.

- Uniswap (UNI): As a leading decentralized exchange, Uniswap facilitates seamless and efficient trading of crypto assets, eliminating reliance on centralized platforms.

- Aave (AAVE): This protocol offers borrowing and lending opportunities for various crypto assets, potentially generating passive income and maximizing your retirement funds.

- Compound (COMP): Compound enables users to earn interest on crypto assets by lending them to borrowers, potentially enhancing returns on your retirement investments.

These projects demonstrate the vast potential of crypto assets in generating passive income and diversifying your portfolio, ensuring a secure future for your retirement.

Securing Your Crypto Assets for a Secure Retirement

Understanding Security and Risk Management in Crypto

The world of cryptocurrency comes with inherent security risks, and it’s crucial to understand these before diving in. But don’t let fear deter you. The key lies in implementing sound security measures and educating yourself about potential vulnerabilities.

Safeguarding Your Crypto Assets

- Hardware Wallets: Store your crypto offline on a dedicated device, ensuring it’s physically secured.

- Software Wallets: Utilize secure software wallets for easier access while taking appropriate precautions like multi-factor authentication and strong passwords.

- Strong Passwords: Never compromise on password security, and consider utilizing a password manager to store and generate strong passwords for all your crypto accounts.

- Phishing Awareness: Be wary of phishing scams attempting to steal your login credentials, private keys, or sensitive information.

- Regular Updates: Keep your wallets and software updated with the latest security patches.

- Secure Exchanges: Select reputable and secure crypto exchanges to minimize the risk of unauthorized access or theft.

Investing in cryptocurrencies for retirement involves embracing a new financial landscape and implementing rigorous security measures. By prioritizing safety and being aware of potential threats, you can maximize the benefits of cryptocurrencies and build a truly secure and resilient retirement plan.

The Future of Retirement is in Your Hands with Cryptocurrency

Investing in cryptocurrencies for retirement requires a proactive approach, a willingness to learn, and a long-term perspective. But the potential rewards are significant. You can unlock a world of financial freedom, taking control of your future and securing your financial well-being for years to come.

Key Takeaways:

- Embrace DeFi: DeFi empowers you with greater control, transparency, and security compared to traditional financial systems.

- Diversify your Portfolio: Expand your retirement portfolio beyond traditional assets and incorporate diverse crypto assets for enhanced returns and risk mitigation.

- Prioritize Security: Implement strong security measures for your crypto holdings, including hardware wallets, strong passwords, and phishing awareness, to ensure the safety of your assets.

- Be a Proactive Investor: Actively manage your crypto assets, stay informed about the evolving market, and adapt your investment strategies to navigate the dynamic crypto landscape.

The future of retirement is in your hands. Seize the opportunity offered by the blockchain revolution and embark on a path to financial freedom and security, utilizing cryptocurrencies as a powerful tool to shape your future.