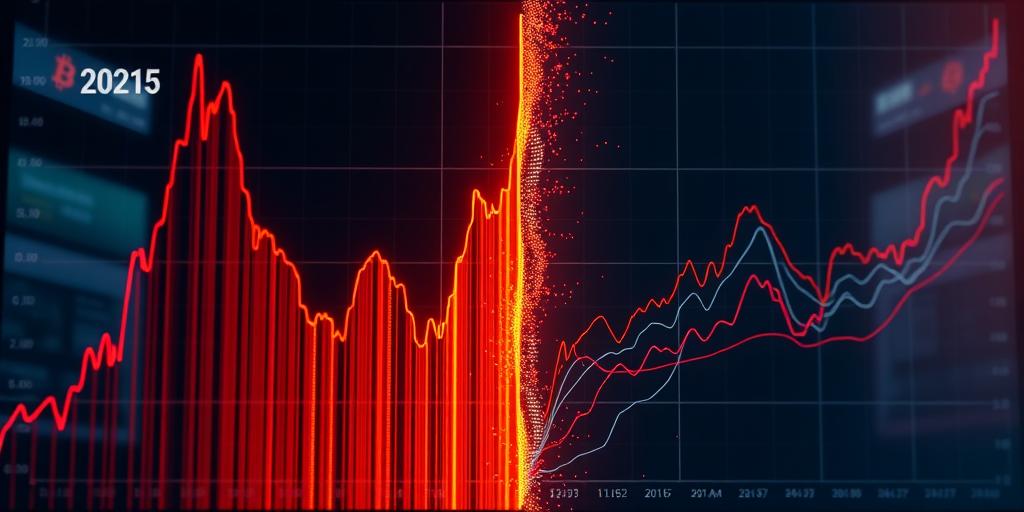

Did you witness the heart-stopping plunge of Bitcoin in 2025? Prepare yourself, because what happened then holds crucial lessons about navigating the volatile world of cryptocurrency and the undeniable importance of portfolio diversification. The gut-wrenching drop from $100,000 to $75,000 served as a brutal wake-up call for many, highlighting the risks of heavily weighted investments and the need for a more robust strategy. This article will unpack the critical lessons from this Bitcoin crash and provide actionable insights into building a resilient investment portfolio that can weather future storms. Get ready to transform your investing approach, and protect yourself from devastating losses.

Bitcoin's 2025 Crash: A Case Study in Risk Management

The 2025 Bitcoin crash wasn't just a random market fluctuation; it was a stark reminder of the inherent volatility within the cryptocurrency market. Several factors contributed to this dramatic decline, including regulatory uncertainty, macroeconomic shifts, and even specific events like the high-profile collapse of a major cryptocurrency exchange. This incident perfectly illustrates how a seemingly secure investment can turn volatile overnight. Understanding these contributing factors is the first step in developing a strategy for mitigating future risks and successfully navigating market fluctuations. This requires a solid understanding of market forces and the ability to adapt to changing conditions. Investing in Bitcoin is not a get-rich-quick scheme; it’s a high-risk investment that requires significant planning and financial prudence. This includes diversification of one’s portfolio.

Understanding the Impact of Volatility

The extreme price swings experienced during the 2025 Bitcoin crash exposed a critical vulnerability: the lack of portfolio diversification among many investors. Those who had heavily concentrated their investments in Bitcoin alone suffered disproportionately compared to those who had diversified their holdings across various asset classes. This points to the importance of risk management and the need to spread your investments across different asset types to mitigate overall portfolio risk. Understanding the inherent risks in Bitcoin and similar assets and balancing them with lower-risk investments can help protect your finances.

Regulatory Uncertainty and its Ripple Effect

The cryptocurrency market is still largely unregulated in many parts of the world. This regulatory uncertainty can lead to sudden policy changes that dramatically affect prices. Government intervention and sudden shifts in regulatory frameworks can significantly impact investment values, and create ripples across the entire market. Diversifying away from heavily regulated investments can help hedge against the impact of major policy shifts. Having a diverse portfolio protects you from dramatic changes in the regulatory environment.

Portfolio Diversification: The Key to Surviving Market Shocks

The 2025 Bitcoin crash underscored the critical importance of portfolio diversification. Diversification is about strategically spreading your investments across various asset classes, like stocks, bonds, real estate, and commodities. By diversifying, you reduce your exposure to the risks associated with any single investment. If one asset class performs poorly, others might compensate, helping to minimize overall losses. Don’t put all your eggs in one basket! This is a classic investment principle and serves as an important lesson from this Bitcoin crash.

Asset Allocation Strategies for Cryptocurrency Investors

Diversification isn't just about investing in different things; it's about strategically allocating your assets based on your risk tolerance, investment goals, and time horizon. This includes determining the optimal percentage of your portfolio allocated to Bitcoin and other cryptocurrencies. Many investors use a rules-based system to ensure they are appropriately diversified, but others utilize more dynamic strategies that allow for adjustments to respond to market conditions. Regardless of the system used, having a clear diversification strategy is essential.

Beyond Bitcoin: Exploring Alternative Investment Options

The 2025 Bitcoin crash highlighted the potential for significant losses in highly volatile assets. To reduce risk, explore opportunities in more stable asset classes, such as index funds, bonds, real estate investment trusts (REITs), or gold. Each asset class exhibits different characteristics and levels of risk, providing different ways to reduce the impact of any one investment’s loss on your portfolio. Understanding the behavior of different investment types is essential for creating a well-balanced portfolio. Investing in blue-chip stocks, high-yield bonds, or commodities are also viable options.

Building Your Resilient Investment Portfolio: A Step-by-Step Guide

Building a resilient portfolio requires careful planning and an understanding of your risk tolerance. Before investing in any asset class, consider the associated risk and your personal financial situation. Begin by determining your investment goals, time horizon, and risk tolerance. Remember, your level of risk tolerance will determine the proportions of your investments, including allocations to higher-risk assets such as Bitcoin. Creating a financial plan that aligns with your risk profile is paramount.

Assessing Your Risk Tolerance and Investment Goals

Before diving into the world of investment, carefully consider your financial situation and risk tolerance. Are you comfortable with potential losses? How much risk are you willing to take to achieve your desired returns? What are your financial goals, both short-term and long-term? These are the questions that need answering before determining the appropriate asset allocation strategy for you. An understanding of your risk profile is the cornerstone of a successful investment strategy.

Diversifying Across Asset Classes for Long-Term Growth

The key to building a resilient portfolio is to diversify your investments across different asset classes. This not only reduces risk, but it can also improve your chances of long-term growth. Consider spreading your investments across different sectors, geographies, and asset classes, in order to create a resilient and diversified portfolio. Always rebalance your portfolio periodically to maintain your desired asset allocation. Regular portfolio rebalancing is crucial to adapt to market fluctuations and maintain the overall balance of your investment strategy.

Don't let another Bitcoin crash catch you off guard! Diversify your portfolio today and safeguard your financial future. Click here to learn more about building a resilient portfolio.